Expedia: Some Value Here, But Uncertainty Too High Now (NASDAQ:EXPE)

Table of Contents

Mike Coppola/Getty Photographs Enjoyment

Financial commitment Thesis

I think the reopening rally bought forward of itself for many journey corporations. Expedia’s (NASDAQ:EXPE) stock regularly broke all-time highs during 2021 and early 2022 even as the fundamental business was sluggish to get well. Now that the stock has dropped by more than 50 %, I feel it may perhaps be a good time to assess the organization in much more detail.

Checklist of Expedia’s Houses (Expedia Once-a-year Report 2022)

The organization has some energy. By way of its quite a few homes, Expedia is broadly diversified throughout most essential marketplaces in the travel marketplace. The core company also seems to have stabilized from the effects of the pandemic.

However, there is superior uncertainty with regards to the business’s operations a lot more than a couple of months into the long run. I just really don’t believe that the most likely enterprise outcomes present enough advancement to make the enterprise definitely undervalued. The business enterprise also has taken on extra debt, diluted its shares, and stopped returning income to shareholders as a consequence of the pandemic.

For these good reasons I’m not interested in investing in Expedia proper now. But I consider this uncertainty may possibly make a superior acquiring option in the upcoming few of quarters. I’m going to be viewing a couple crucial metrics more than the future few months to evaluate if Expedia results in being a superior value investment decision.

Metric #1: Booking Developments

There are some promising indicators for a comeback in vacation. Expedia’s final earnings simply call was upbeat, with administration indicating that lodging bookings for February, March, and April were up even above 2019 levels. The business is doubling down on Vrbo, which it says was the quantity 1 downloaded app in the initially quarter of this yr.

In accordance Expedia’s most current 10-Q filing, quarterly gross bookings are up drastically, practically 60% yr about year. The very last quarter’s income margin also strengthened by 1.1 proportion factors. These reflect a potent advancement in journey developments so significantly this 12 months.

But all of Expedia’s headline quantities are still down about their 2019 levels. Lodging, which management used the most time concentrating on, seems to be the most resilient section. But the company’s air vacation, advertising, and media segments are all properly off their 2019 stages.

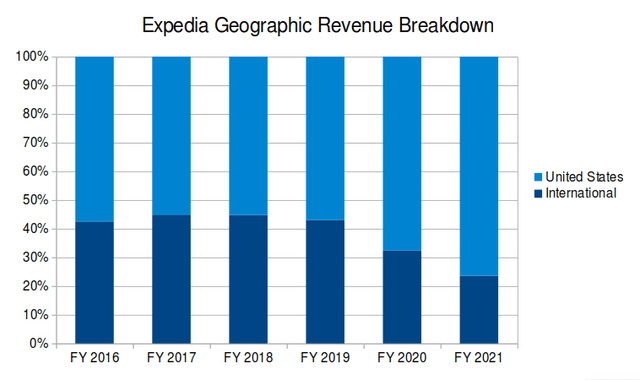

Made by writer making use of facts from Expedia’s 10-K filings

The international travel section is also battling. Revenue from outside the United States has historically built up 40% to 45% of profits, but in 2021 that range was down to just 24%. I’m hoping to see a rebound in this and other segments as pandemic restrictions continue on to be lifted. I feel these booking developments and the business’s in general income blend will be a bullish signal if they commence to shift back again to historic averages.

Metric #2: Air Vacation

A further key indicator I’m viewing is airline journey. This is related to in general vacation developments, and I anticipate solid desire for flights to correlate with amplified need for journey. This is specially suitable for Expedia due to the fact air income has been down so a lot more than its other segments. Profits generated from Expedia’s air section was down above 70% from 2019 to 2021, in comparison to just less than 24% for its lodging phase.

Even as anxieties of a recession intensify, I assume most indicators for airfare have remained unusually robust. TSA passenger throughput quantities have found strong expansion yr in excess of year, although most figures are however down from their 2019 degrees. Global air journey has also started a sturdy rebound, even surpassing its 2019 degrees in some places.

What I’m particularly searching for are signals of ongoing, sustained toughness in air journey into the late summer months, drop, and winter season as indications that the travel business is even now in high demand from customers. For some a lot more in depth details I’ll be wanting at both of those earnings and ahead advice from key carriers such as Southwest Airlines (LUV), Delta Air Strains (DAL), and United Airways (UAL).

Metric #3: Enterprise Travel

A further important part of the small business I’m seeking at is Expedia’s B2B section. Enterprise vacation is a different main company phase that has been sluggish to rebound from the pandemic. On its last earnings phone Expedia’s CEO known as the phase “underrated by the markets” and mentioned that he expects it to outgrow the consumer company on a proportion foundation around the subsequent many decades. I also concur that this is a substantial chance for Expedia, and I like the way the company is building far more obtainable B2B choices for its partners.

At the identical time, I’m unsure how quickly the demand from customers could bounce again. Some facts points stage to a slower recovery. For instance, the American Lodge and Lodging Affiliation released a report in April expressing they anticipate 2022 organization journey income to be down by virtually one particular quarter as opposed to 2019. I’ll be watching out for this segment’s effects on Expedia’s forthcoming quarterly studies.

Expedia’s Money Place

During the pandemic Expedia had to undertake some drastic steps in purchase to remain economically secure. The business minimize its dividend, possibly for very good. Share buybacks have been suspended indefinitely. Because the previous report just before the pandemic, Expedia’s shares excellent have enhanced by about 12%. Total-time staff have been slice by more than 40%. Expedia also experienced to significantly maximize its debt situation. More than the yr of 2020 Expedia took on over 3.7 billion dollars in supplemental web personal debt.

Though all of this has a damaging effect for existing shareholders, I don’t assume it is as negative as it may possibly seem to be. This degree of share dilution is not as extreme as other travel organizations. Carnival (CCL), for instance, experienced to almost double its shares fantastic to stay afloat. Expedia also utilized the possibility to spend off its significant interest financial debt. Most of the new financial debt issued is extremely lower interest. Particularly, one particular billion is in % fascination convertible notes, and a different billion is in 2.95% notes not thanks until finally 2031.

Additional instantly, it appears to me that this crisis is subsiding. Over the earlier few of quarters, the small business has begun the system of deleveraging. The enterprise has paid out back $1.9 billion in financial debt about the past year. On its last earnings call, the company’s CFO talked about this process:

Bear in mind that you will find 2 main means that we can get that [Debt to EBITDA] ratio down. A single is shelling out down credit card debt, which is a little something that we are actively pondering about and next growing into it from an EBITDA standpoint. We do expect EBITDA to be strong as we get into this calendar year as we get more absolutely recovered. And if tendencies carry on, and we are undoubtedly likely to look at proving our ratios in this region to open up up some much more possibilities for EBITDA.

But even as the business’s income flows normalize, I think the business will nevertheless be working with the financial penalties of the pandemic for some time. For prospective investors, it means it may well be a when prior to Expedia has sizeable cost-free money stream to return to shareholders.

Final Verdict

It’s difficult to value a company like Expedia in this natural environment. Classic valuation procedures like comparables or discounted cost-free hard cash flow designs rely on forward projections for earnings and earnings. I’m not sure these ahead projections are valuable in an natural environment with these kinds of significant uncertainty.

The ordinary analyst projection sees Expedia recovering to its 2019 amounts sometime in the following two several years. For me, I want to see some a lot more concrete development in direction of this objective as well as decreased uncertainty encompassing common vacation need.

As I see it, Expedia’s shares are again to trading at in close proximity to their pre-pandemic amounts. Regrettably, this is with a lot more shares fantastic, increased debt, and a a great deal far more uncertain journey environment. Mainly because of this, I’ll go on Expedia’s inventory appropriate now. But I am looking at it carefully, since I think it may perhaps present a good benefit expenditure chance as soon as the company’s restoration trajectory will become more obvious.